Search in the website:

Finance / Page 13

NSFAF Recovery Campaign Nets Only N$41 Million in Three Years…Publication of defaulters’ names remains a possibility

By: Hertha Ekandjo Since the launch of its national recovery campaign in 2021, the Namibia Student Financial Assistance Fund (NSFAF) has managed to recover approximately N$41 million from over 95,000 beneficiaries who owe the institution. However, out of the vast sum owed to NSFAF, totaling over N$9 billion, only around 4,000 beneficiaries have […]

Analysts Urge Responsible Spending Ahead of Election Year

By: Dolly Menas As Namibia gears up for the upcoming general elections scheduled for November, experts are advocating for prudent government spending, particularly in critical sectors like education and healthcare. Speaking at a pre-budget public discussion on Tuesday, Salomo Hei, Managing Director of High Economic Intelligence (HEI), highlighted the expectation of increased government […]

Bank Windhoek Appoints Ngula as Head of e-Money

By: Staff Writer Bank Windhoek has announced the appointment of Candy Ngula as its new Head of Electronic Money (e-Money). In her new role, Ngula will lead the charge in driving the value of e-Money while overseeing its growth and optimization across the bank’s Retail Banking Services. The appointment was officially announced on […]

The Plight of the Destitute: Buy this Wooden Craft or Donate Cash

By: Mathias Hangala For months, a group of Angolan citizens has been residing near Kuryangava’s Stop ‘n Shop market area, sending their youngest members onto the streets of Windhoek to sell wooden crafts and household products, as well as to seek financial donations. Since The Villager’s last report on the group, their numbers have […]

EIF and NASRIA Forge Collaboration on Climate-Related Insurance Products

By: Justicia Shipena The Environmental Investment Fund of Namibia (EIF) and Namibia Special Risks Insurance Association Limited (NASRIA) formalised their partnership through a Memorandum of Cooperation (MOC). This collaborative effort is poised to drive the development and accessibility of insurance products tailored to address the challenges posed by climate change. The signing of the […]

Namibia’s Fixed Currency Presents Challenges in Tackling Inflation

By: Justicia Shipena Governor of the Bank of Namibia (BoN), Johannes !Gawaxab, says the limited flexibility of Namibia’s fixed currency, which is tied to the South African Rand, in combating inflation. Namibia recorded an annual inflation rate of 5.4% for January 2024, slightly higher than December 2023’s 5.3% but lower than January 2023’s […]

Vehicle Sales Surge in January, Marking Eight-Year High

By: Hertha Ekandjo Vehicle sales in Namibia for the month of January have soared to their highest levels in eight years, signalling a robust start to the year for the automotive industry. According to the latest Vehicle Sale Report by Simonis Storms Security (SSS), a total of 950 new vehicles were sold last […]

MPC Announcement: Unchanged Repo Rates or a Shift in Strategy?

By: Justicia Shipena Economists anticipate that the Bank of Namibia may opt to keep the repo rate unchanged rather than implementing a cut or increase in response to the slowing inflation. Currently, the repo rate stands at 7.75%, a level that has remained unchanged since December 2023. Economist Mally Likukela believes the repo […]

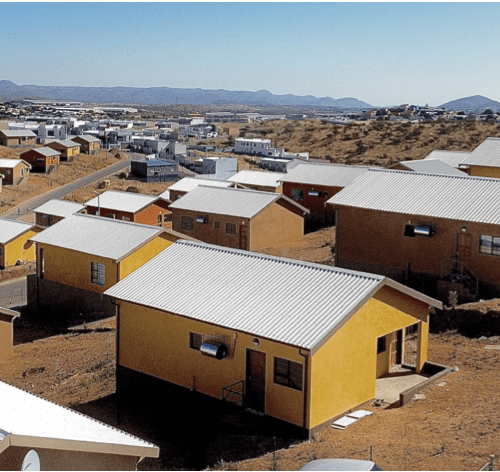

Long-Term Affordability Challenges to Persist in the Housing Market

Justicia Shipena In its latest House Price Index report, the First National Bank (FNB) has signalled concerns over long-term housing affordability challenges that are expected to persist, further impacting the housing market. Additionally, the bank anticipates a modest reduction in interest rates, contributing to the overall constrained conditions in the property sector. “The […]

Stability in the Rental Market Anticipated

By: Justicia Shipena FNB Namibia has projected a relatively stable rental market, citing the moderation of inflation and the sustained peak of the repo rate at 7.75%, with a gradual cutting cycle expected to extend through 2026. The bank’s rent price index reveals that the gross rental return on residential properties for the […]