Search in the website:

Finance

DBN Presents a Gloomy and Mixed 2024/25 Performance

By: Nghiinomenwa-vali Hangala For the financial year (FY) started in April 2024 and ended March 2025, the Development Bank of Namibia (DBN) approved N$912.7 million in funding across priority sectors, an increase compared to the previous year’s approval of N$906.1 million. This was distributed through 128 loans approved during the 2024/25 FY, compared […]

Namibia’s Savings Above Half a Trillion

By: Nghiinomenwa-vali Hangala The assets of non-banking financial institutions (NBFIs) are trickling above half a trillion, reaching N$528.2 billion as of the end of the third quarter of 2025 (30 September 2025), NAMFISA revealed. These NBFIs include insurance, medical aid funds, retirement funds, friendly societies, the capital market, and microlending. Most of these […]

Govt Plan to Switch N$2.3 Billion on Tuesday

By: Nghiinomenwa-vali Hangala The government, through the central bank, will attempt to persuade investors to switch their N$2.3 billion investment in the GC26 Bond to other long-term bonds to avoid repaying the borrowed money next year. The government announced this auction through a central bank notice released last week. Market participants or […]

Govt Financing Needs to Increase to N$33.6 billion

By: Nghiinomenwa-vali Erastus The gap (budget deficit) between the government’s planned expenditure and its expected revenue for the 2026 Financial Year is expected to widen from N$12.8 billion to N$15.8 billion. As a result, together with other financial commitments made by the government, the amount of money to be borrowed this financial year […]

Prosecute Financial Crimes to be De-Greylisted

By: Nghiinomenwa-vali Hangala Namibia’s chance to be delisted as a country susceptible to financial crimes – due to its fragile ability to detect and stop said crimes – hinges on proving that it can investigate and prosecute money laundering and terrorist financing cases. According to the update provided by the country’s financial watchdog, […]

N$5.5 million to Subsidise Potato Production

By: Nghiinomenwa-vali Hangala The Namibia Agronomic Board (NAB) has availed a total of N$5.5 million to be allocated for the 2025/2026 financial year potato value chain development scheme . This scheme forms part of the recently launched NAB 5-Year Crop Value Chain Development Strategy. NAB revealed revealed the allocation of these funds […]

Banks Agree to Reduce the Cost of Money

By: Nghiinomenwa-vali Hangala Local commercial banks have collectively agreed to reduce the cost of money by narrowing their margin by a total of 25 basis points (0.25%). The reduction will be done in two phases, with the first reduction of 0.123% implemented 3 days ago. The central bank has confirmed that various commercial banks in […]

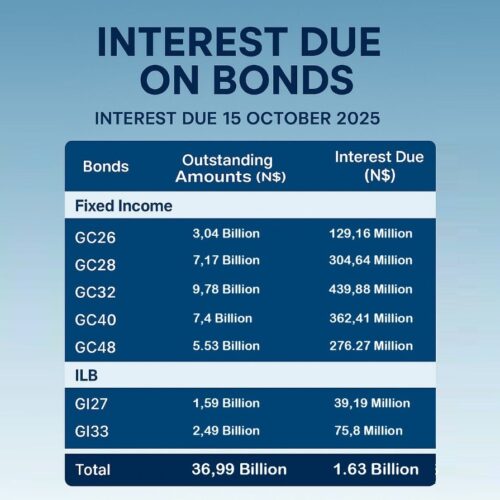

Govt to Pay N$1.6 billion in Coupon Interest in October

By: Nghiinomenwa-vali Hangala Updates from the Central Bank have indicated that the government will be paying N$1.6 billion in coupon interest to its bond investors on 15 October 2025. Information from the Bank of Namibia revealed that, as part of its seven outstanding (fixed income and inflation-linked) government bonds, it will be paying interest/coupons […]

Govt Debt up by N$66 Billion in 5 Years

By: Nghiinomenwa-vali Hangala As of Friday last week, local investors have lent N$139.7 billion to the Namibian government to fill its budget shortfall for the past five financial years through bonds and treasury bills. This is an increase from N$73.8 billion, which was borrowed from the domestic market at the end of 2020, according to […]

Domestic Capital Mostly Invested in Listed Equities and Debt

By: Nghiinomenwa-vali Erastus Most of the country’s N$289.9 billion capital that is deployed domestically through investment managers is invested in listed equities (shares) and debt instruments as of 31 March 2025, according to the Namfisa 2025 First Quarter report, which was released this week. This has been the trend for the past years. […]